- Excel sheet for monthly expenses how to#

- Excel sheet for monthly expenses software#

- Excel sheet for monthly expenses download#

Excel sheet for monthly expenses software#

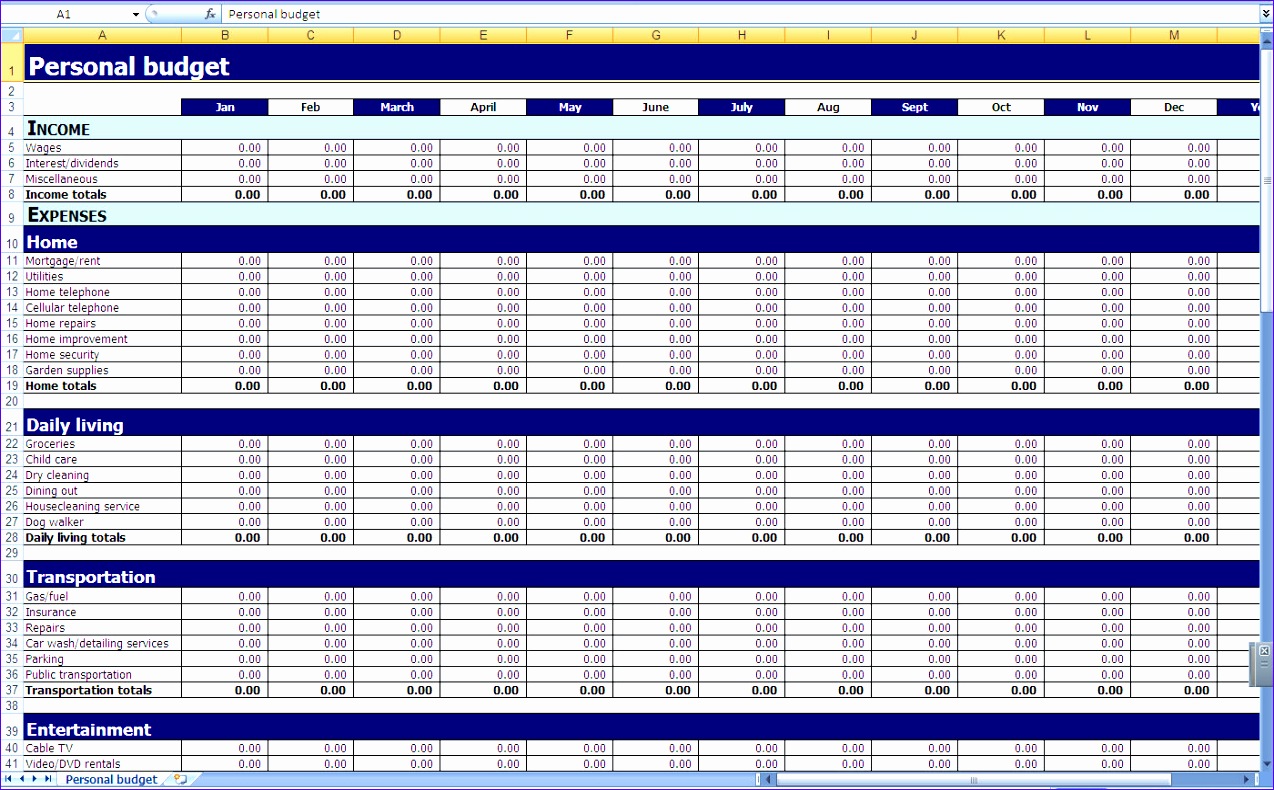

If you don’t have software like Microsoft Excel installed in your computer, you can use the software of your choice. Launch the spreadsheet software of your choice.Here are the steps to follow when making your own monthly budget template: In the long run, you will discover yourself coming closer to financial freedom. You can use the template as a guide to pay your bills, save money or make it to your next payday without getting into debt.

Some think that this is a difficult task but it will make it easier for you to keep track of your finances. One way to have control of your expenses is through the use of a monthly budget template. How do I create a monthly expense spreadsheet? Some of the latest ones allow you to keep track of your investments too. If you have a more comprehensive financial portfolio, you may opt for a budgeting app instead.

Excel sheet for monthly expenses download#

You can find many of these templates online and download them for free. There is a lot you can discover when you go through this process. Some credit cards tag your purchases automatically in categories making things easier for you. Through this, you get a sense of your cash flow each month.Īfter going through your accounts, group these into categories. Looking through these accounts helps you pinpoint your spending habits. Identify all of your money habits then create an inventory of all your accounts including all of your credit cards and your checking account.

Excel sheet for monthly expenses how to#

Here are pointers to consider on how to start tracking through your monthly expenses template: It is a good practice to keep track of your expenses regularly through a bill tracker template as this gives you an accurate overview of where you’re spending your money.

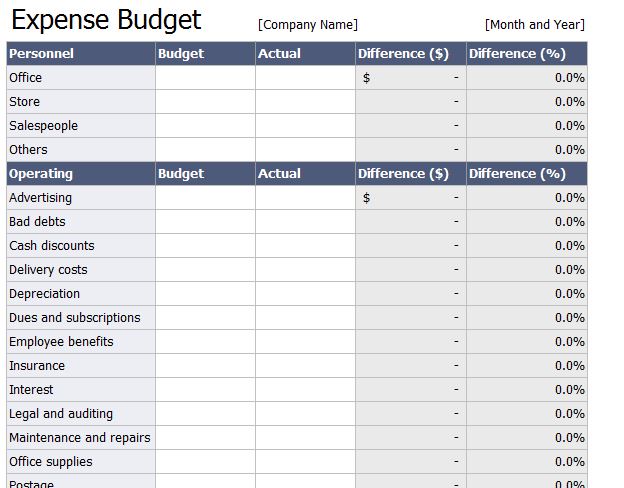

When making your monthly bills template, here are some examples of monthly expenses to include: These are expenses that you cannot do without as these keep you warm, alive, and safe. Before you make a budget, you should first have a list of your individual expenses.įor instance, take your needs. In general, a budget contains spending guidelines for specific expense categories. Identifying recurring and common expenses like mortgage or rent payments, helps you plan your expenditures and make a monthly expenses template.

0 kommentar(er)

0 kommentar(er)